- Home

- Index

-

My Books

- Book List

- Writing/Reading Articles Listing

-

My Short Stories

- What God Lost

- What God Lost — Part 2

- When Hope Was Lost

- A Battle in the Heavens

- To Live Forever

- Finding Peace

- Empty Hands

- From Fire and Thunder to Love and Submission

- The Coming One

- Forgiveness Made Possible

- The Innkeeper's Wife

- Do You Have The Right Words?

- The Lamb of God As Told by a Scribe

- What Love Is This?

- When Heaven Came Down

- Family

- Faith

I write about what matters...to you---

women, wives and moms---

about your family, faith and future.

I write about what's hard, what helps and what heals.

I show you how it's done. And not done.

I hold your hand as you find what matters to the Savior.

And let go of those things that mattered to you, but not to Him.

I write about what matters...to Him.

Sonya Contreras

What Do You Value? Your Money Talks.

Show me your bank statement and I’ll show you what you value.

How we spend our money tells what we think is important.

Maybe you can barely pay bills and don’t have money for any extras.

You think if you just made more money you would have more.

Studies show, winners of lotteries are destitute five years after their win.

Why?

It’s not how much you make, but how you spend what you have.

Write down for one month every time you buy anything, even that cup of coffee or candy bar.

After one month, place your expenses into categories: food, housing, transportation.

Calculate each category’s percentages.

[Take what you spent, divided by what you earned.

For example: if you spent $500 on groceries and earned $1,000 that month,

500 ÷ 1000 = 0.50 x 100 = 50%.]

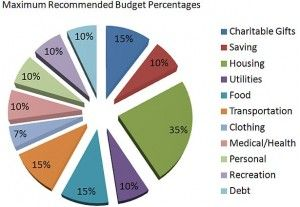

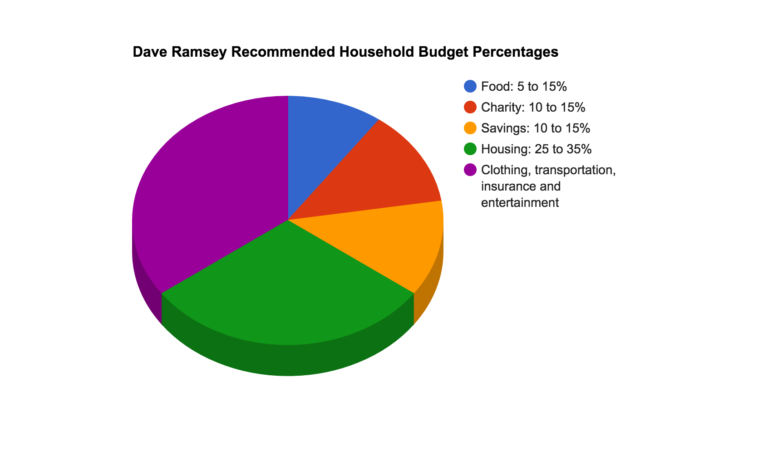

Compare your percentages with what is suggested for each of those categories.

Here are two recommended charts for money distribution.

In our above example, if you spent 50% on food you’d be really lovin’ food!

Evaluate what you spend.

Don’t have any extra when emergencies come?

That debt category (listed in the first pie chart) is paying for things you wanted now but couldn’t wait.

Want more money and freedom to breathe a little?

Learn to wait.

Do without.

Skimp.

Eliminate all debt (even your house payment)---now you’ve earned freedom and have more money.

Use that extra money to save for those emergencies.

How? Is your car payment more than 15%? (Remember that 15% includes insurance, registration, gas, maintenance. It shouldn’t be maxed out on just the car payment.)

Is owning a new car worth paying more than what you should?

Consider other options.

You sacrifice what you must, to have what you value.

I could tell you stories of our adventures with junky cars growing up.

We could see the road between our feet in one of our cars. (For my CAL readers, salt is used on the roads to prevent/melt ice. Salt also eats holes in metal cars.)

When one of our cars suddenly caught fire, my sister parked it, walked home, vowing never to drive a junky car again.

When my family moved to Indianapolis, my mother worked a job she hated, so us girls could attend a Christian school, in spite of my dad’s continued unemployment. She valued protecting us. Her money went to school tuition.

When our vacuum cleaner stopped working, we brushed our carpets on our knees to collect the pet hair.

Mom made our clothes or found them at thrift stores. Keeping up with peer pressure was not an option.

While I worked at summer camp, my family moved to a smaller house in a much poorer neighborhood. When I returned, I slept on the coach and kept my belongings in the garage. (I had three more sisters who still were in grade-school.

I see the fruits of her sacrifice today.

What you value, you do.

Today, those lean years taught me we can do without. We can survive on less.

But it also taught me money opens doors.

When you have money, you have choices.

Do you use a credit card?

The Bible says, “The borrower becomes the lender’s slave.” Proverbs 22:7.

When you owe someone anything, you are their slave.

You can’t do anything with your money, you must give it to your master.

What happens when a crisis comes?

You have nothing.

Your marriage suffers. (Stress and fighting over finances is one of the leading causes of divorce.)

Debt makes you stay at a job you hate.

You serve your master.

How do you get out of debt?

Spend less. Do without. Pay for what you can afford. Wait.

Pay off the lowest debt first. That gives you momentum and encouragement to continue.

Need help? Let Dave Ramsey, a Christian financial adviser, help you.

By eliminating debt, you can save for those emergencies. They aren’t crisis now because you’ve prepared for them.

You also have money to help others. You can now give.

Pay cash.

After several of our bank branches closed, I’ve been using my debit card more. It makes spending sooo much easier.

When you pay cash, it hurts. You must hand over your money. You see the value of that dollar.

Money is a gift.

Solomon, the wisest man, said of money, “Give me neither poverty nor riches; feed me with the food that is my portion, that I not be full and deny You and say, ‘Who is the Lord?’ or that I not be in want and steal, and profane the name of my God.” Proverbs 30:7-9.

Are you a spender or a saver?

Most couples have one of each. One can save for the long haul. In fact once they’ve saved for that big purchase, they have trouble handing the money to buy what they wanted.

Whereas the spender never sees his money. It passes from his hand to …gone, without effort, thought and struggle. He struggles with waiting for anything, after all, the sale is NOW.

Seek a balance. Waiting helps you evaluate what is essential, important, needed—not urgent, frivolous, and wanted. But waiting without reason can ruin opportunities.

Money is a tool.

Jesus didn't condemn money. The Scriptures say, "the love of money was the root of all evil." I Timothy 6:10. It is how we value money, not money itself that becomes evil.

The man in the Bible who asked his neighbor for food when company came at night needed help now.

Be alert to others' needs.

A community church in our area often helps families when fire destroys everything. They enter the destroyed area with bulldozers, dump trucks and volunteers to clean up the victims’ land and house.

When I told them of one family’s loss, they asked twenty practical question about how to help… the children's ages (for clothes, shoes), if they had pets, where they were staying,…things I didn’t even think about.

I was overwhelmed with what I didn’t know.

Yet these people were burdened with what they didn’t have.

That’s where your values show. How can you help?

If you're in debt so much you can’t help another, what do you value?

Recently a couple attending our church had their house burn.

The church provided funds to help pay for the first month of an apartment. Our members donated dishes, food, furniture—what we had for what they needed.

It wasn’t time for us to say, “maybe tomorrow.” They needed help now.

That’s what the body of Christ does: help each other.

But we had the resources to help. We wouldn't if we were in debt because of our own wants.

We had money because of what we valued.

What do you value?

It shows by how you spend your money.

Displaying 1 comment

Author of Biblical fiction, married to my best friend, and challenged by eight sons’ growing pains as I write about what matters.

Receive weekly articles by giving your email address below:

Helps

Find more articles here:

Holiday Helps

Feeling Disorganized?

Cutting Costs with DIY Cleaners

Helps—An App Worth Having

Ramblings from a Gardener

Gardening

One Pot Miracles

Settling In

Are You Vaccinated?

Reading Chair Worth Using

More Breads to Give

What Moving Has Taught Me—part two

What Moving Has Taught Me—part one

Elderberries to the Rescue

What To Do Now?

Stuff that Helps

Making Your House Work for You

From Ugly to Something of Beauty

Seasons of Gardening from a Tired Mom

Canning

Emergency Spending

The Dreaded Family Picture

Let's Talk about Laundry

Camping with Children

Camping List

Camping Recipes

Traveling with Children by Airplane

Traveling with Children by Car

Saving Time with School

Shopping to Save Money

Tips for Clutter Management

Why De-clutter?

Twelve Steps to Take the Hectic out of the Holidays

Tips for the Holidays

Tips To Save Time in Making Meals

Tips To Make Food Stretch

Are You Seeing Black?

What Does Your Clothes Say about You?

What Season Are You?

Faith

Find more articles about faith here:

The Need for Meaning Even in Pain

Reminders of What's Important

God's Unmeasurable Love

A Quarter of a Century Spent for Our Country

What Were You Thinking?

Who Are You Watching?

Boundaries for a Better Life

God's Boundaries

Memories of a Hero Mom

The Ripple Effect

How Do We Think Like Jesus

Litany of a Waiting Woman

Ever Cook a Frog?

New Year's Reminders

They Galled Her Gammy

When God Speaks

A Russian Christmas Story

Be Thankful

Be Grateful

Are You Tired of the Same, Old Thing?

(reprint)

Laughter—Why Laugh?

Mom

Are You Disturbed?

Unity of the Brothers

Encouragements To Declutter

Do You Have Too Much Stuff?

Too Much Stress

Getting Past the Noise—The Value of Silence

Are You Scatterbrained?

How Good Are You?

Looking for Something Good To Read?

A Cup of Cold Water

I Will Trust When I Cannot See

Encouragement—What Is It?

Being in God's Presence

"Einstein and the Professor"

When God Is Silent

Do You Crave Beauty?

Using Stories to Discipline

The Danger of the Wrong Story

Using Stories to Teach Lessons

God is in charge of the future

November Dare Joy Challenge

Ungratefulness

Developing an Attitude of Gratitude

Looking for Jesus

What Do Your Prayers Reflect?

Life's Little Pleasures

Daniel—Greatly Loved by God

Take Every Thought

Jars of Clay

What Do Your Words Reveal about Your Heart?

How Do You Get Strong Faith?

Too Busy for God's Word?

How Do You Think Like Jesus?

Reflections from a Mom

Pain—What's It Good For?

Why Marry?

Consider the Robin

One Life Who Made a Difference

What Day Are You Living In?

Interrupted by God

Is Jesus Really the Answer to Everything?

Are You Beat Up?

What's Your Hurry?

Are You a Manipulator?

Are You Salty?

Are You Condemned?

Trying to Understand?

Do You Expect Answers to Your Prayers?

Do You Eat Your Stress?

Need Focus?

Going through Trouble?

Immanuel—God with Us

Looking for a Relationship?

When God Says, "No!"

What Do You Do with Left-Overs?

How Great Is Your God?

Are You Needy?

How Do You See Sin?

What Do Your Words Mean?

Is Evil Overwhelming You?

Those Aha Moments

Is Your Soul Happy?

Are You Ignored?

Looking for the God Moment

Do You Know Truth from Almost Truth?

I Believe in Jesus—What Now?

Do You Have Your "Son"-Glasses On?

Less Is More

Singing His Praise

Are You Trying To Do It All?

What Do You Do with All These Prayer Requests?

Have a Problem?

Do You Know How to Pray?

Looking for God in Every Moment

Are You Receptive to God's Blessings?

Tell the Senate: Mothers Aren't Birthing People

Is Your Life Complicated?

How Do We Fight Evil?

Fearfully and Wonderfully Made

Giving Up or Taking Away

the Bible is simple

Are You a Dripping Faucet?

What's Your Testimony?

The Final Move

Be Careful What You Wish For!

Are Your Prayers Answered?

I Choose Joy

What Have You Learned from Your Hardship?

Who Are You Trying to Change?

What's Your Five-Year Plan?

The Danger of "Aloneness"

My Colors

Are You a Whiner?

Are Your Works Approved?

Do You Think You're Stressed?

Is Your Soul Feeling Ragged?

God Speaks to the Heart of the King

What about the Details?

Have You Felt the Long-Suffering of God?

How Does God Lead You?

Do You Have Enough?

Don't Carry More than You Need

Cast the Seed

God Is Faithful

Are You Deceived?

Are You Essential?

Are You Safe?

Are You Tired of the Same Old Thing?

Does the World Make Sense?

Have You Seen God's Majesty?

Do You Feel Judged?

If You Only Had One More Day To Live

Are You Understood?

Do You Long for the Word of God?

Slow Down and Smell the Dead Leaves

Are You Hospitable?

Our Heritage Is Bought by Blood

Are You Disturbed?

Are You Depressed?

I Did It My Way

Finding the Simple Life with Meaning

The Simple Life

Do You Have the Right Words?

Did Your Dream Die?

On the Other Side of the Fence

Marijuana, Mental Illness, and Violence

Confessions of a Desperate Mom

Saving for Tomorrow

A Wedding Remembered

Who Will Stand in the Gap?

Are You a Protector or a Ruler?

Who Are You?

Are You an Image Bearer or a Wad of Cells?

Are You a Watchman?

Where Do You Find Meaning?

The Lamb of God as Told by a Scribe

What Love Is This?

Remember: The Symbols of Passover Explained

Tea and Rest

Do You Have Peace?

What Makes a Marriage Work?

When Life Is Awful

Are You Strong Enough?

Rules

Seasons

Be Faithful through Suffering

Do You Know the Word?

Wake Up! Strengthen What Remains

Are You Spit in God's Mouth?

Is Jezebel in Your Midst?

Do You Stand Against Satan Himself?

Are You Tired of Being a Mom?

What in the World Is Happening?

It's Not My Story

How Would Your Faith Compare?

Are You Sinking?

Are You a Rule Follower?

Useful for Him

An Intimate Moment with Mary

The Worldview that Makes the

Underclass

Thoughts to Ponder

What Does It Take To Know the

Heart of God?

See the Story in the Stars

Do the Scriptures Burn You?

Being in His Presence

Contentment: It's Not for the Timid

How Secure Are You?

How Do You Respond To Stupid People?

The Earthworm Is My Hero

Heart Issues or Issues of the Heart

Things Aren't Always What They Seem

More faith articles are found here:

under the Table of Contents. Also available in book form.

Or here:

under the Table of Contents. Also available in book form.

Articles on Suffering can be found here,

under Table of Contents. Also available in book form.

Special Days

Remember: The Symbols of

Passover Explained

Aug 12, 2017 The Heavens Declare the Glory of God

July 4th, Freedom

What Is an American Soldier?

Valentine's Day: A Day of Love?

Memorial Day-A Day To Remember

Veterans' Day-To Honor Our Men

Fall Colors

First Thanksgiving Day

Proclamation

Christmas: Stories behind the Songs

Christmas: Stories behind the Songs, part 2

We never had much so I've always had to be so careful with our money, but I realize that now that I don't have to be Quite so careful, I'm not. Great idea to write down everything I spend money on to see where it's really going. Thanks for the reminder, I'm sure we all need it from time to time.